3 Questions to Ask Before You Use Your Emergency Fund

5 Min Read | Sep 29, 2023

In a world of uncertainties, living with the security of an emergency fund is priceless. Whether you’re sitting on $1,000 in your starter emergency fund or about $15,000 in your fully funded emergency fund, you’ll have peace of mind knowing you’ve got money saved for a rainy day.

Why? Because it’s going to rain.

But you’re ready.

Still, you might wonder when to use your emergency fund. If something comes up, do you just need to rethink priorities? Should you move things around in your budget to make space for this new expense? Or is this a legit emergency?

Of course, if you can move things around to cover the expense, do that first. But remember, it’s going to rain. There’s no shame in using your emergency fund if you really need to. That’s what it’s there for.

When to Use Your Emergency Fund

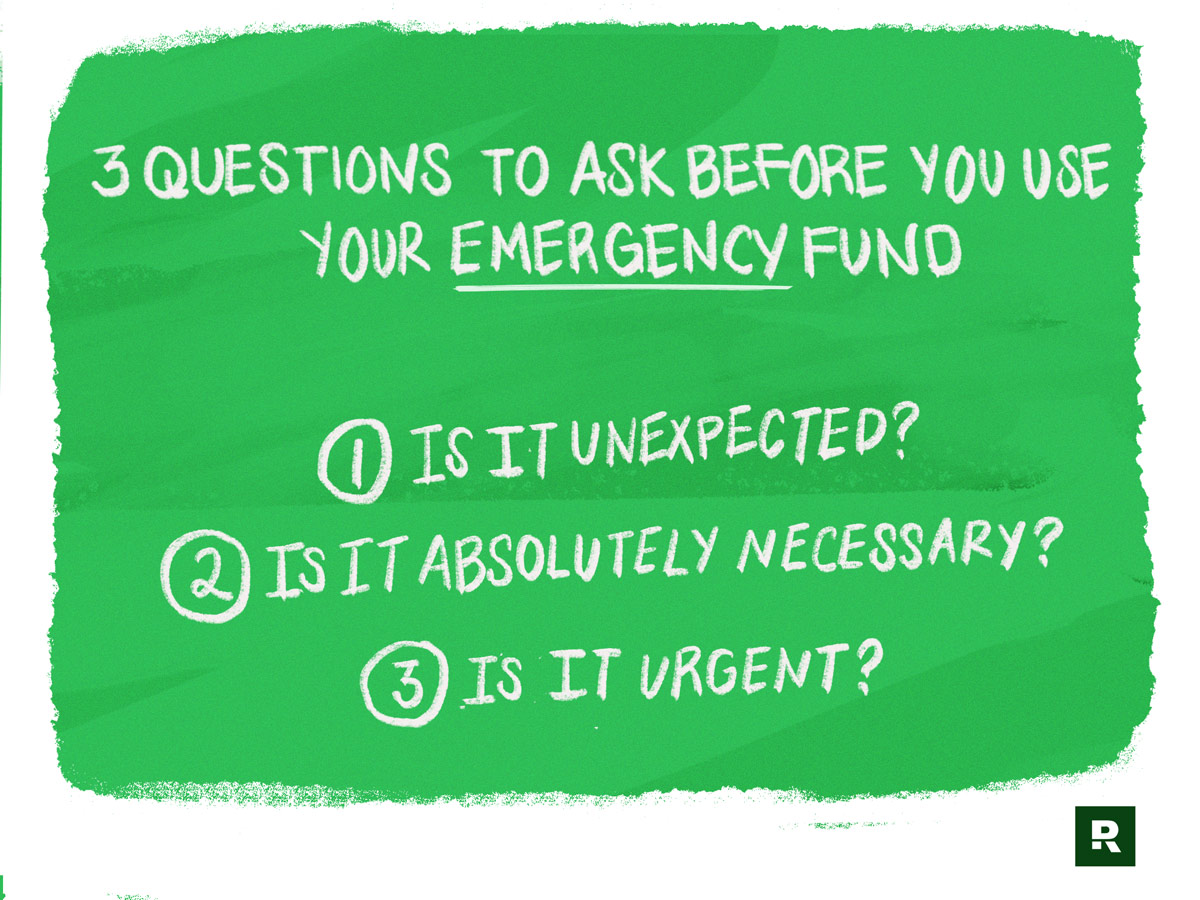

Ask yourself these three questions to make sure you’ve got a real reason to dip into your emergency fund.

- Is it unexpected?

- Is it absolutely necessary?

- Is it urgent?

1. Is it unexpected?

Turns out Christmas happens the same time every year. (It’s December 25.) And that semiannual car insurance payment? Well, you know that’s coming too.

If you’re not budgeting ahead for these expected expenses, it’s time to start. Otherwise you’ll be tempted to use your emergency fund for something that’s not an emergency. It’s just poor planning.

Here are some examples of the difference between unexpected and expected expenses:

Usually Unexpected:

- Job loss

- Pay cut or fewer hours

- Storm damage to your home

- Car accident repairs

- Emergency medical expenses

Should Be Expected:

- Christmas

- Back-to-school shopping

- Regular monthly expenses

- Basic home or car maintenance

- Routine doctor visits

You probably noticed “job loss” tops the list of usually unexpected expenses. That’s the main reason the fully funded emergency fund is set at 3–6 months of expenses—so a job loss doesn’t destroy your finances.

It gives you the security of knowing you can still pay the bills while you look for a new job. A job loss is soul-crushing enough without having to worry about how you’ll keep the lights on.

If the life event or expense you’re looking at is truly unexpected, then it’s most likely time to use that emergency fund.

2. Is it absolutely necessary?

Most of us would say we know the difference between a want and a need. But sometimes the line between the two gets a little blurry.

For example, self-care is important. But a weekend getaway isn’t necessary. Don’t use your emergency fund for that. A good library book or a hike in the woods can be just as good for you. And both of those happen to be free.

Okay, if that seems too obvious, here are a few more examples:

Needs:

- Loss of reliable transportation

- Higher-than-anticipated tax bill

- Unexpected travel in time of family crisis

Wants:

- Car upgrade to newer model

- Latest iPhone or technology gadget

- Last-minute vacation opportunity

If your car goes kaput, you need transportation—so use your emergency fund to buy something affordable and reliable you can pay cash for.

But don’t dip into your emergency fund just to upgrade your decent car for one with a million bells and whistles. That’s not necessary.

3. Is it urgent?

Ever had an employer who said everything on your to do-list was urgent? Or been around a kid who needed everything right now? It’s exhausting. And if you live with that attitude about your spending, you’ll soon exhaust your emergency fund.

Don’t. Do. That. Instead, avoid impulse buys and practice the art of patience whenever possible. Here are some examples of urgent vs. not urgent:

Probably Urgent:

- Broken AC in the middle of summer

- Sudden, out-of-state move

- A cracked tooth (thanks to a pesky popcorn kernel)

Can Wait:

- The sale of the century at your local Walmart

- A good deal on shoes at a bad time for your budget

- Concert tickets

Remember—your emergency fund is all about long-term security, not instant gratification. Don’t use it on a whim. But also, don’t be afraid to use it when you really need to.

Are you prepared for life’s emergencies? Learn how to get there with Financial Peace University.

Just be wise and ask those three questions to check yourself so you don’t wreck yourself (or your budget).

Know When to Use Your Emergency Fund Wisely

Hey, if you’re facing a real emergency, don’t freak out if you have to use your emergency fund. That’s what it’s there for! You worked hard to save up this protection. Let it protect you.

Take a deep breath. Ask yourself those three questions. Talk it through with your accountability partner. And move forward in confidence. Because the sun will come back up and dry up all that rain.

Soon you’ll be back in your EveryDollar budget rebuilding that emergency fund. But for right now, take care of you and yours.