7 Things You Can Do With Your EveryDollar Budget Right Now

6 Min Read | Dec 15, 2023

No matter if you’re new to the budget world or feel like a pro, we can all start to feel a little stuck sometimes. If you aren’t getting the traction you want with your money goals, or you feel like budgeting is just super hard in general, check out these seven things you can do inside your EveryDollar budget right now to up your budgeting game.

- Easily make a new budget every month.

- Create (and remove) unlimited budget categories and lines.

- Adjust through the month.

- Track your spending.

- Share an account with your spouse.

- View budget reports.

- Split transactions.

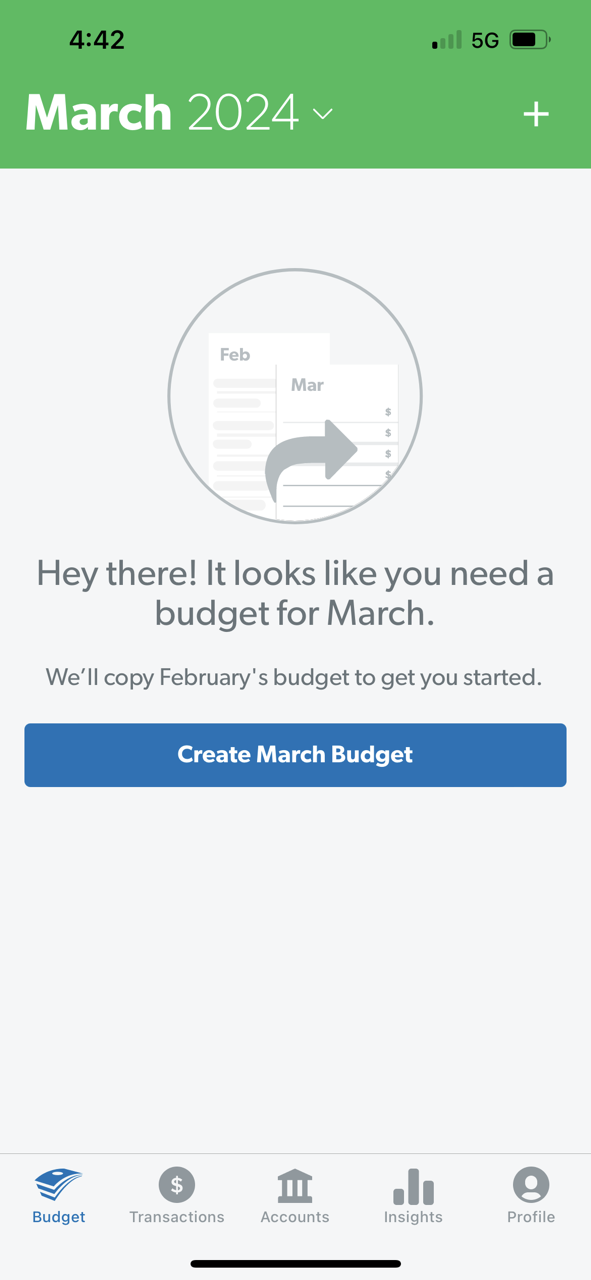

1. Easily make a new budget every month.

You don’t just make a budget one month and stop there. You need to make a new one—every single month.

Sure, your monthly expenses stay pretty much the same every month. But not exactly the same! So always make a new budget before the month begins so you’ll be ready for everything coming your way.

In EveryDollar, you can simply copy over this month’s budget to the next and then make whatever changes you need.

2. Create (and remove) unlimited budget categories and lines.

First, let’s get technical and quickly define budget categories and budget lines. A budget category is like a filing cabinet. And budget lines are like the file folders that go in it. For example: You’ve probably got a transportation budget category, and under that you have budget lines like gasoline or a car repair fund.

With EveryDollar, you can create as many budget categories and budget lines as you like. Also, when life changes, adding in a new budget category or line is super easy. Getting a new pet or expecting a baby? Hop on your desktop version of EveryDollar, scroll down to the bottom, click Add Group, and name your category whatever you want. To add a line, you can click Add Item under your preferred category in the app or online.

And if you don’t need a line anymore? Delete it! Your budget should reflect your life, and EveryDollar makes it easy to do just that.

3. Adjust through the month.

Here’s the deal: You might think a budget is set in stone. That you fill out those planned amounts and live by them to the end, no matter what. To some extent, that’s true. You don’t want to ignore the $100 you budgeted for eating out and go wild hitting that drive-thru every day on the way home.

But just like other things in life, your budget will change, and you need to make adjustments throughout the month to keep on top of those changes.

What does this look like in real life? If your water bill’s a little lower than expected, just lower that planned amount to the actual amount. Hey—now you’ve got extra money! Move it to another budget line that went a little over or throw it at your current Baby Step. This is part of the power you’ve got as a budgeter!

4. Track your spending.

Here’s one of the best budgeting tips we have: Track all your spending. All month long. And when it comes to EveryDollar, you’ve got options for how you do it.

In the free version, manually type in your transactions and make sure they go in the correct budget line. You can do this after every purchase you make, or you can hop into your online bank account on the regular and enter everything at once.

Or you can upgrade your experience to the premium version of EveryDollar and connect your bank to your budget. Then all your transactions will stream on in. Automatically. You just drag and drop each to the right spot!

Start budgeting with EveryDollar today!

No matter which way you do it, make sure you do it. Track. Your. Transactions.

No more keeping track of all those paper receipts and getting into heated discussions about who spent the last of the grocery money on frozen pizza. Instead, you and your spouse can share an EveryDollar account and be on the same page—and in the same budget. One of you signs up for the account, and both of you use that login info on any device. This will be a communication game changer for your relationship!

6. View budget reports.

There’s one more premium feature that deserves a call-out: budget reports. Does that give you images of businessmen in suits pointing to charts and graphs while saying “synergy” and “gross profit margin?” This. Isn’t. That.

EveryDollar budget reports help you see how your money habits line up with your money goals. You’ll see income vs. money spent, spending total breakdowns, and a clear view of your income over the months. This is super handy for budgeters with irregular incomes and anyone wanting to know how those side hustles are adding up (literally) over time.

Budget reports help you spot a spending problem so you’ll know where to dig in and make changes. Then you can start making real progress on those money goals.

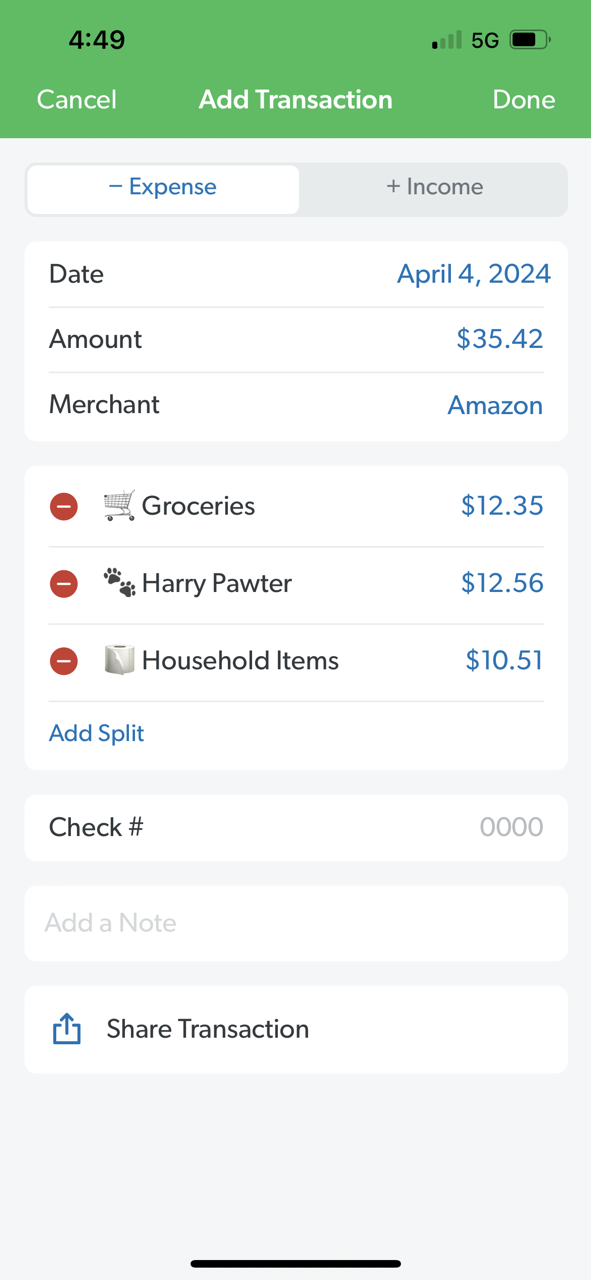

7. Split transactions.

We talked about how important it is to track all your transactions. But this is the 21st century, and we all know that one Target order might not fit neatly into one budget line. If you ran in and bought tissues, breakfast bars and a mini puppy cardigan, how would you track that purchase in your budget?

You split that transaction, friends. You split it good. And it’s simple in EveryDollar. When you open up the transaction, tap on Budget Item(s) and select as many as you need. Then type in the amount you spent toward each and tap Done and Done. Now that one Target run can easily be tracked to your household items, groceries and pets budget lines!

Your budget should accurately reflect your actual spending, and splitting your transactions is one of the best ways to do it!

Time to Budget

Hey, maybe you’re tackling all of these on the regular. If so, give yourself a high five.

Or maybe some or all of this is fresh news to you. Don’t worry. Just get in your EveryDollar budget and start working on each tip one at a time. And remember, budgeting well takes time and effort—but it’s totally worth it. You’ll stop wondering where your money went because you’ll be the one telling it where to go. Every. Single. Dollar.

Don’t give up.

You’ve got this.