Inflation sucks. It can feel like a tug of war—with your wallet getting stretched thinner and thinner every day. And you’re probably in the middle of it right now. Our research shows three out of four Americans have noticed rising prices. And 85% say it feels like their money doesn’t buy as much.

That’s inflation.

What can you do about it?

Good news. You don’t have to sit back and accept defeat. You can overcome inflation. And it all comes down to the budget. Let’s talk about what that actually means and how you can budget your way through these rising costs.

How to Adjust Your Budget for Inflation

First of all, if you don’t have a budget—set one up pronto. A budget is a plan for your money. And right now, you need a solid plan. This is the first step to lowering your financial stress and prepping your money for whatever’s coming—even (and especially) inflation.

Secondly, that budget needs to be zero-based. That means your income minus your expenses equals zero. Why? Well, the zero-based budgeting method gives every dollar a job—that you assign it! Because dollars you don’t put to work get spent accidentally. And with inflation making things even tighter than normal, you don’t have room for mindless spending.

If inflation has your money out of whack, you might soon realize you’ve been overspending. Maybe you’ve been relying on credit cards to float from month to month and fallen into a debt trap with interest piling up all around you.

Hey, don’t worry. All this adjusting we’re about to walk through will help you get back to the balance that a zero-based budget brings in life!

Once you’ve got a budget, do these six things to reduce the impact of inflation:

1. Review Your Spending

Costs are on the rise, and you feel it. But you might not know exactly where it’s hitting you the hardest. The first step in fighting inflation is to get out that budget and look over your spending. Yep—it’s time for a little detective work. (No Sherlock cap or magnifying glass required.)

Which budget lines have been the hardest to keep under control? What do you spend money on that you could do without for a while? Where have you been overspending?

We can probably guess two answers for that last one: groceries and gasoline. That brings us to our next point . . .

2. Find Ways to Save

Once you know the budget lines inflation is hitting the hardest, you can start finding ways to save. Here are some quick examples:

- Cut back on grocery spending by picking generic products, meal planning, and buying in bulk (when it makes sense).

- Save on transportation by combining your errands, joining gas rewards programs, ditching the extra junk in your trunk, and using the cruise control.

- Lower your electric bill by replacing your air filters regularly, only running appliances when they’re full, and turning off the dang lights when you aren’t using them. (You aren’t Motel 6.)

- Learn coffee shop or restaurant savings hacks to spend less on eating out. (Hint: Sharing is caring for meals and bills.)

These are just a few ways you can save money and combat inflation.

3. Earn Extra Money

Your expenses are going up. You can help your budget by making your income go up too. How?

Well, a good side hustle goes a long way. And some jobs you can do from your very own couch in your very own flannel PJs! Yes, it means effort. But the bump in income with this extra work could balance out the increase in costs.

Start budgeting with EveryDollar today!

Quick callout (and this is super important): Beware lifestyle creep. Make sure you include that side hustle money as income in your budget so it doesn’t get spent impulsively or accidentally.

By the way, if you need a budgeting tool, we happen to have one. It’s called EveryDollar, and it’s free and wonderful. Just saying.

4. Cut Some Expenses

Another way to stand up against inflation is to cut your spending. Remember when you were reviewing the budget and asking yourself what you could do without for a while? Hey, it’s not fun, but trimming budget lines out altogether may be just what you need right now.

Cut the cable or limit yourself to just one TV streaming service. Don’t buy clothes (unless it’s an actual need). Drop the premium music subscription and endure the ads. Stop eating out. Make coffee at home.

Okay, some of those might feel super limiting and horribly strict. But say these words to yourself: This. Isn’t. Forever. Right now, you’ve got to make some financial changes so you don’t fall into debt trying to maintain your current lifestyle during a time of inflation.

Pick as many of those expenses to cut (for now) as your budget needs. And say these words again as you do: This. Isn’t. Forever.

5. Shop Around

Costs are on the rise everywhere, but you can still find better prices if you take the time to shop around. What does that look like? Well, it means looking at multiple websites before you make an online purchase.

For groceries, you don’t have to stay loyal to where you’ve always shopped just because you’ve always shopped there. Find the cheapest grocery store (that still carries what you need, of course!) by comparing prices online and in real life.

Also, check out the grocery stores with gas rewards points (not a credit card—but a loyalty card that gets you gasoline at a discount). Stores that offer that perk might end up being the biggest cost-saver. Or try the grocery store that’s closer to home so you can save on travel.

Speaking of travel—do yourself a savings favor and download GasBuddy. This app helps you check gas prices on the go so you can find the best deal.

It may take more time to find the options that will save you the most money, but shopping around so you can defeat inflation is worth it.

6. Adjust Budget Lines

You’ve freed up money from cutting back or making more, so you need to adjust your budget lines. Time for some addition and subtraction. (Note: You can adjust totals after you do the other steps or while you’re doing them, whichever you prefer.)

In 2021, groceries cost a monthly average of around $260 (for singles) to just over $1,000 (for families of four) on the moderate spending side of things.1 But with inflation at its highest level in decades, you probably need to add more to that grocery budget line today.

Gas? Yeah, we don’t even like to talk about it. The price per gallon has doubled in some places. Which means you might have to double how much you plan to spend.

Yes, it hurts—but it will be okay. You will be okay! That’s why you’re taking these steps. Because you aren’t taking this lying down. And you aren’t going into debt. You’re being intentional with your money and adjusting the budget so it’s prepared to fight.

You’ve got this.

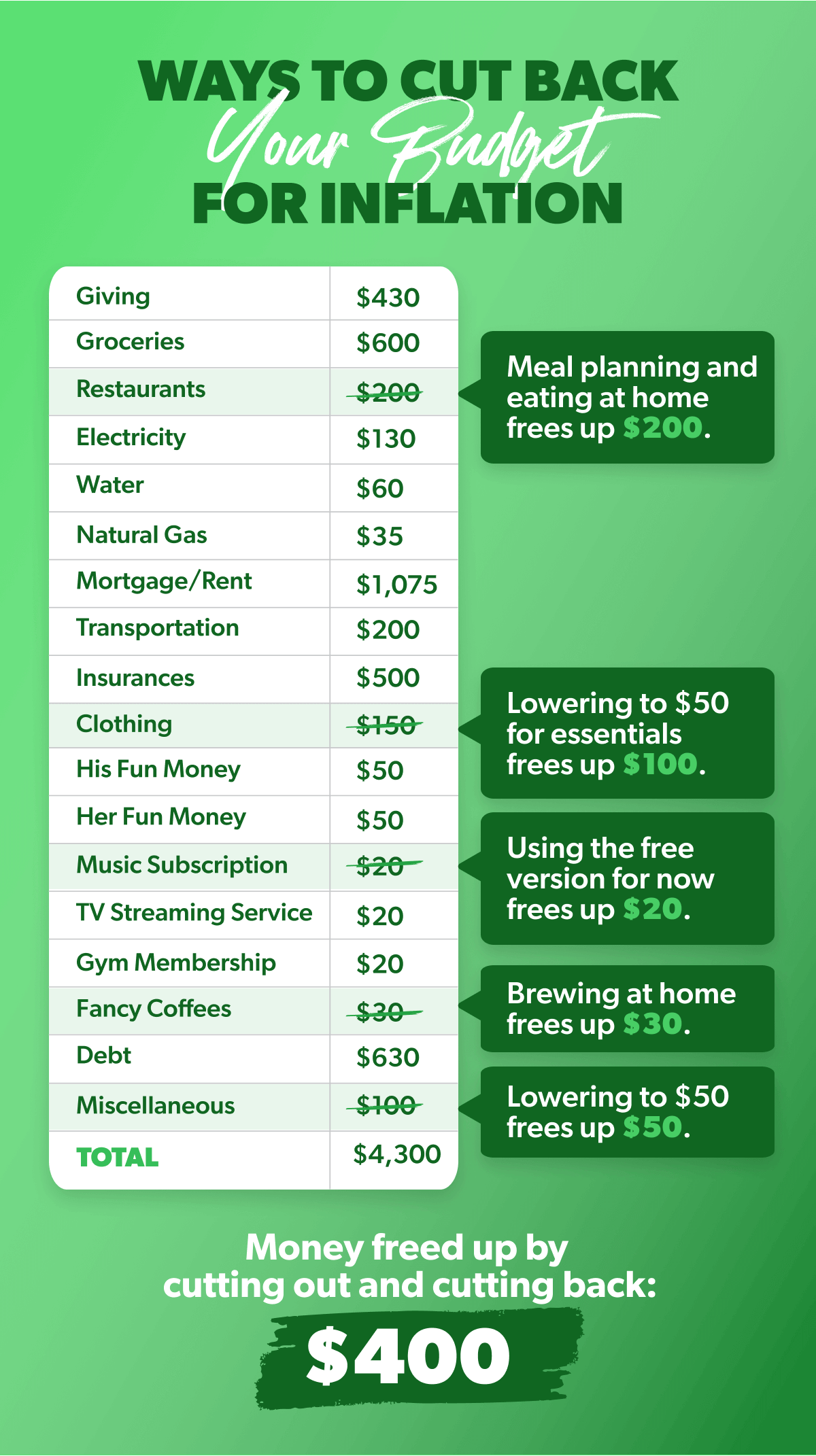

Example Budget Adjusted for Inflation

Let’s say we’ve got a couple named Rachel and Jeff who are making adjustments to balance out their budget. They looked over their past spending and saw their grocery and gas spending have inched up the last few months.

They didn’t notice before because they were relying on credit cards (and racking up debt and interest). But now they see something’s got to give so they don’t keep falling behind. Together, they decide to cut some extras. Check out their changes (and their thinking) below.

Jeff and Rachel freed up $400 to throw at the two budget lines that were being hit the hardest by inflation. Yes, they’re living without some things for a while, but it’s worth it to them to know they can pay cash for everything in their budget and get out of the debt they were ignoring (and adding to).

Tips for Adjusting Your Budget Throughout the Month

Up until now, we’ve talked about adjusting your budget just because inflation got out of hand.

But to get the most out of your budget, you need to check in and make changes throughout the month. And by changes, we mean you need to get into the habit of keeping your eyes on your money—which is how you stay in control of your money.

Here's how you adjust your budget throughout the month.

Track Your Transactions

If you make money, track it in your budget. Add it to your income budget lines. If you spend money, track it in your budget. Subtract each expense from the budget line it belongs in.

Do this all month long. Find a rhythm of tracking your transactions so it’s done before those receipts get washed in your back pocket or covered in smoothie leaks in your car cupholder.

Pro tip: Upgrade your budget to get the premium features of EveryDollar, and you can connect your bank to your budget. That means your transactions stream right in, so you just drag and drop them where they go. Quicker, easier, more accurate? Yes, yes, yes.

Change Budget Line Totals When Needed

When you’re tracking, you might need to change some budget line totals. Did we hear you gasp just now? Maybe you’ve been told you simply cannot change anything about the budget once you make it. Well, that’s false.

Yes, you need to stick to your budget (meaning you don’t overspend or ignore the plan you’ve created). But life isn’t perfectly predictable, and neither is your budget.

Sometimes it’s a good change you’ll have to make, like when your water bill comes in lower than your planned amount. Lowering that budget line feels even better than getting a free side of fries with your burger.

Other times, you’ll have to increase an amount. (That’s not fun. At all.) But you just move the money you need out of a different budget line, and it all balances out.

(P.S. If you have to take money from somewhere, start with those extras, like eating out or getting your brows waxed. You can always learn to DIY your brows online. Right?)

Whenever you need to change a budget line total, take a deep breath and remember that budgets are made for this. As long as you aren’t spending more than you make—and you’re covering your needs—you’re going to be fine.

Save Extras for Later in the Month

Speaking of extras—if things are tighter in your budget because of inflation (or for any reason, since expenses can change some from month to month), wait to pay for the extras until later in the month.

Once you’re sure food will be on the table, gas will be in the tank, the electric bill will be paid, and the rent is covered—then you can hit up your brow girl or get those tickets to that emo band reunion festival.

Again, you may have to totally cut some extras (for now). Others can just wait until the essentials are taken care of.

You Can Fight Inflation With Your Budget

Okay, now you know that your budget is exactly what you need to fight inflation—and you know how to do it. So, let’s do it!

If you’re old-school and want to start with our Quick-Start Budget form, go for it. Sometimes having the numbers in front of you, on an actual sheet of paper, is a great place to begin. Then download EveryDollar so you can make the month-to-month budgeting process way easier.

You and your budget will make it through this. And remember—inflation is tough. But you’re tougher.