Your home is one of your biggest comforts—and expenses. So, it makes sense that home is a perfect place to save money in both big and small ways. Let’s talk about ways to save on home expenses like utilities, insurance, renovations, mortgage and rent.

Ways to Save on Utilities

1. Cut the cable.

These days, cutting the cable doesn’t mean going without any form of home entertainment. With options like Apple TV+, Disney+, Amazon Fire TV Stick, YouTube TV, Netflix, Hulu, Sling TV and more, you can find pretty much anything you’re looking for. Cutting the cable and adding in a less expensive option gives you unlimited binge-watching fun!

2. Buy a programmable (smart) thermostat.

Lowering your heating bill is one of the quickest ways to save on home expenses. If you adjust your thermostat seven to 10 degrees while you’re at work, you can save as much as 10% a year on heating and cooling!1 If you have a manual thermostat, you can add this step to your morning routine—along with tooth brushing, bagel toasting, and coffee brewing.

But do you know what you can’t do with a manual thermostat? Set the temp back to normal before you return home, so you aren’t welcomed to a sauna or a meat locker. But with a programmable (smart) thermostat, you can set it and forget it! Over time, you can save cash and stay comfortable.

3. Use more efficient light bulbs.

About 15% of your energy budget goes to lighting.2 One of the quickest ways to trim down the costs here is to purchase more efficient light bulbs. If you replace the most-used fixtures in your household with LED bulbs, you can save an average of $225 per year.3 Plus, these energy efficient bulbs last longer, which means you replace them less often—so you save even more money.

4. Don’t leave the light on.

While it’s a welcoming gesture to leave the light on for guests or family members, it’s a big waste as well. When you leave a room, switch off the light.

Train everyone in the house to do the same. If you get pushback, think about getting motion-sensor lights. They’re inexpensive and you won’t have to worry about anyone in your house forgetting to turn off the lights when they leave a room.

5. Save on showering.

Heating water can take up to 20% of your home energy use, so shower time is the perfect time to save money.4 If you don’t want to wash off in cold water, just spend less time in the shower.

Or if you’re up for a bigger up-front investment, switch to a more energy-efficient water heater. This will spill savings into all your hot water use, like washing dishes, clothes, pets and hands. You can still feel fresh and clean while also managing your money and energy better.

6. Check your insulation.

Want to shave money off of your annual utility bill? Make sure your home is air sealed and well insulated.5 (Insulation is that pink stuff in your walls and attic that you thought was cotton candy as a child.)

If your home is not well insulated, you could be shooting some of that heating and cooling straight into the streets. Okay, that’s not exactly how it works. But if you ignore this one, your units could be working overtime to keep your house the perfect temperature, which means more energy lost and more money spent.

7. Regularly keep up with HVAC maintenance.

This is a tip straight from financial expert and bestselling author Rachel Cruze. You know how we’re conditioned to get the oil changed in our car on a regular basis? How many of us get our HVAC checked out by professional regularly too? Show of hands, please. Oh, we see you there in the back. Nice!

Start budgeting with EveryDollar today!

But for the rest of us who have never heard of or done this, establishing this yearly routine is an excellent way to save money. A tune-up costs around $100, but it can extend the life and improve the function of your unit.

Rachel also reminds us to change out our air filters! Those dusty chumps can mess up your air flow if you aren’t consistently swapping out old filters with new ones. Also, think about it. Yuck. Change your air filters.

Ways to Save on Homeowners or Renters Insurance

1. Switch insurance agents.

Most people set up their insurance and leave it until they move. If this is you—first, we say a big bravo for getting homeowners or renters insurance in the first place. Next, we want to encourage you to check in on it.

Talk to an independent insurance agent. Their loyalty is to you, not to a specific company, so they’ll shop around until they find the best fit and rate for where you are in life. You can save hundreds a year with minimum effort.

2. Choose higher deductibles.

You know you’re an adult when people start throwing out terms like investment portfolio, itemized deductions and deductible at dinner parties. Even the words dinner party are so grown up, right? But at that dinner party, you might find yourself nodding your head without really understanding what on earth people are saying. Like—what is this deductible everyone’s talking about, and how does a higher one help you save money?

When you get homeowners or renters insurance—which you need—the deductible is the amount of money you would pay out of pocket before your insurance company pays their portion.

Insurance policies with higher deductibles have lower premiums—meaning they cost you less monthly! Of course, you’d have to pay more in an emergency, so wait to raise that deductible until you’ve got your fully funded emergency fund in place to cover anything that—God forbid—comes your home’s way.

Ways to Save on Home Renovations

1. Take on one manageable project at a time.

When you look around at the outdated countertops, stained carpets or mismatched fixtures in your home, it might feel like you can never invite anyone over until it all gets done. But instead of maxing out credit cards on a huge reno or sitting around feeling discontent, budget for any big purchases a little each month, or knock out smaller changes one at a time.

Watch for sales along the way. You can have an impressive before-and-after photo to share on social media. It just might take you a little longer to get from start to finish. But when you’re done, you can have all the ta-da without any of the debt.

2. Save up for bigger renovations.

If you’re dreaming of a huge remodel, you can cash flow it. Seriously. It takes budgeting, saving and waiting—but you can take responsible steps toward making your dream home remodel a reality. Start by pinpointing the project, researching the cost, and then setting up a sinking fund in your EveryDollar budget.

Be sure you’re making a smart investment by planning renovations that increase your home’s worth and make it a nicer place for your family to live. In other words, put your money where the payoff happens both now and later.

3. DIY home repairs when you can.

It’s pretty fantastic what you can learn to do on YouTube these days. Contour your makeup until you look like a completely different person. Learn self-defense moves that rival Chuck Norris. And watch step-by-step guides to basic home repairs. That last one can come in quite handy when you need to fix a simple toilet leak but don’t want to pay an hourly rate for what might be a five-minute job.

But keep in mind: Certain jobs—such as electrical or structural repairs—should be left up to the professionals. Don’t risk your life or home to save money.

4. Barter for repairs.

For those assignments that need an expert, do you know someone who’d be interested in trading skills? You could offer to design their website, photograph their family, or help them file their taxes. Go old school and barter your expertise for theirs.

Ways to Save on Your Mortgage or Rent

1. Downsize your house.

There are plenty of financial reasons to downsize. Maybe your mortgage is eating up a huge chunk of your income, your kids recently moved out, or you just don’t need a place in the center of the action anymore. If any of these apply to you, it could be time to move on. Literally.

You may even net enough to pay cash for your next house and enjoy a downsized life without a mortgage! That could save you thousands of dollars a year to cash flow home renovations, add to your retirement, and start your folk-style, boy band tribute group without financial pressures or guilt. Smaller home, bigger dreams. It might be the trade of the century.

If you're looking to downsize your home, connect with a trusted real estate agent.

2. Figure out if refinancing is right for you.

Refinancing your mortgage is all about lowering the overall amount you pay for your house—not scoring a lower monthly house payment. But remember that buying a house is a long-term investment, and the timing for refinancing your mortgage should be a long-term consideration, not a quick-fix solution.

We recommend you check the math to see if refinancing is right for you. If needed, you can connect with a mortgage expert.

3. Save up a proper down payment.

Things you should never rush: deepening a relationship, baking macarons, and buying a house. We can’t help you with the first two, but we have plenty to say about the last one.

Don’t buy a home if you aren’t financially ready. What’s that mean? First, you’ll need to be out of debt and have an emergency fund of 3–6 months of expenses in the bank.

Next, you’ll need a down payment saved. If you have at least a 20% down payment, you’ll miss out on paying for private mortgage insurance (PMI), which next to the stomach flu going around at work, is one of the best things to miss out on.

But if you’re a first-time home buyer, around 5–20% is okay too, though you’ll have to pay the nasty PMI in that case. And whatever you do—avoid FHA and VA loans! Always.

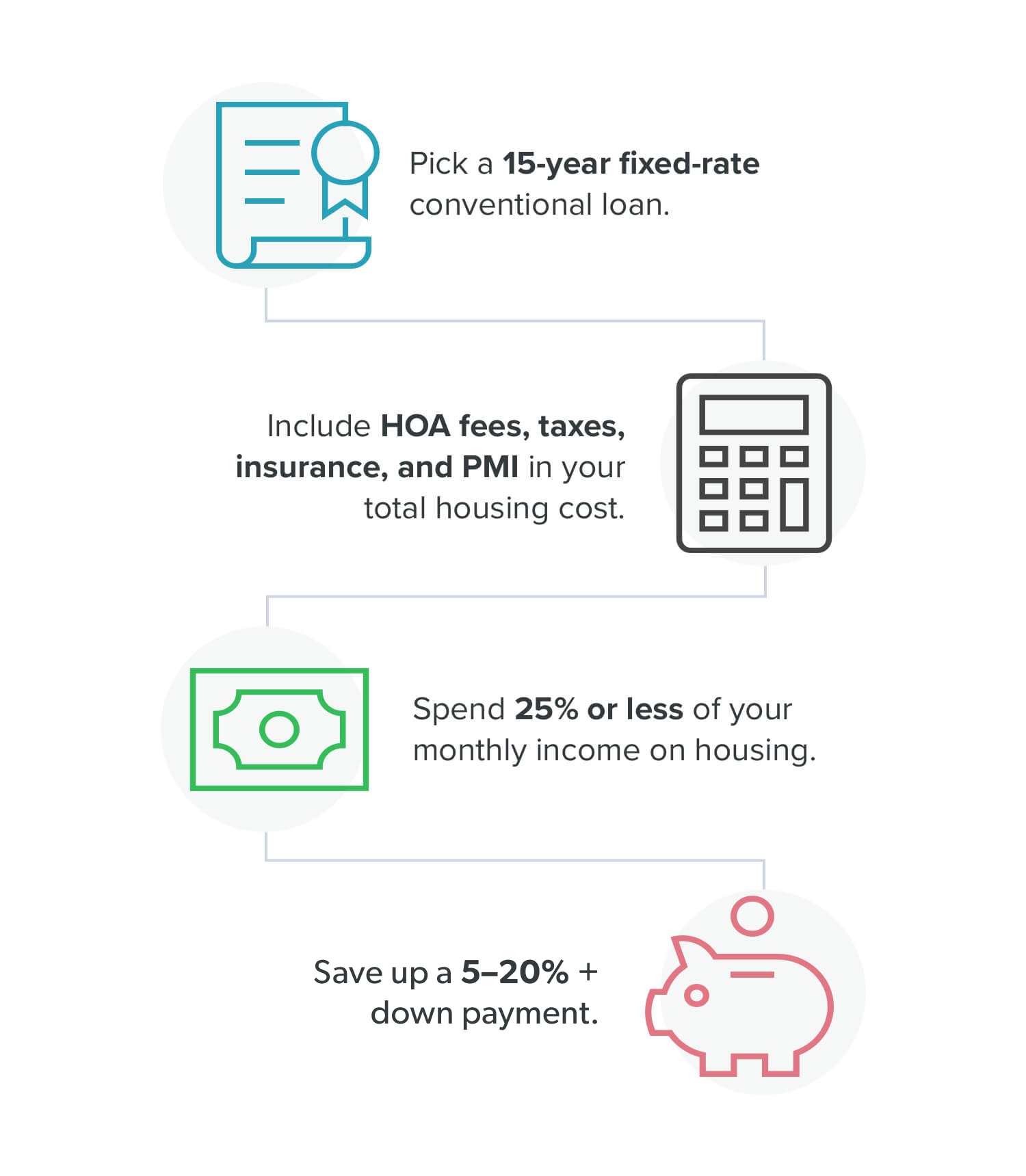

Check out this handy graphic for all the other details on how to buy a home that will be a blessing—not a curse.

4. Buy or rent an affordable home.

Notice that “spend 25% or less of your monthly income on housing” bit in the graphic above? This is one of the top ways to save on housing. And whether you buy or rent a house, you do need shelter. But you don’t want to spend so much on your house you can’t afford to ever leave it.

Our advice? Don’t be house poor. Have you heard that term? It’s when too much of your income goes toward your mortgage or rent, leaving you feeling poor in all other areas. Even hermits like to go out for tacos once in a while. Don’t be house poor—be house wise by living that 25% life. It looks good on you.

5. Move to a cheaper apartment.

Maybe that awesome three-bedroom apartment you moved into a year ago doesn’t seem so awesome anymore? After paying a year of higher rent and higher utility bills, you might be rethinking your decision.

If so, smart move! Even though moving can be expensive, it’s worth it in the long run if you can reduce your monthly bills. If there’s a cheaper unit in your complex, go for it! You might not even need to rent a moving truck.

6. Get a roommate.

It’s not just the price of your rent you’ll be splitting when you get a roommate. It’s also utility bills, cleaning supplies, and even furniture and appliances.

So, when you can’t sleep because you’re worried a roommate might go through your closet and "borrow" your favorite sweater without asking, remember how much money you’d be saving. Then breathe slowly and go back to sleep.

Your home should be a blessing to your life, not a bully to your budget. These helpful tips can free up more money for what matters to you. And the best way to keep track of those budget items?

The (free!) EveryDollar budgeting app! EveryDollar makes it super easy to keep up with all your expenses and budget all the extra cash you’ll have when you use these clever ways you save on home expenses every month.