Saving

Read Article

27 Side Hustle Ideas to Earn Extra Cash

Looking for ways to bring in more cash? Give one of these ideas a shot.

Latest Articles

What Is FAFSA and How Does It Work?

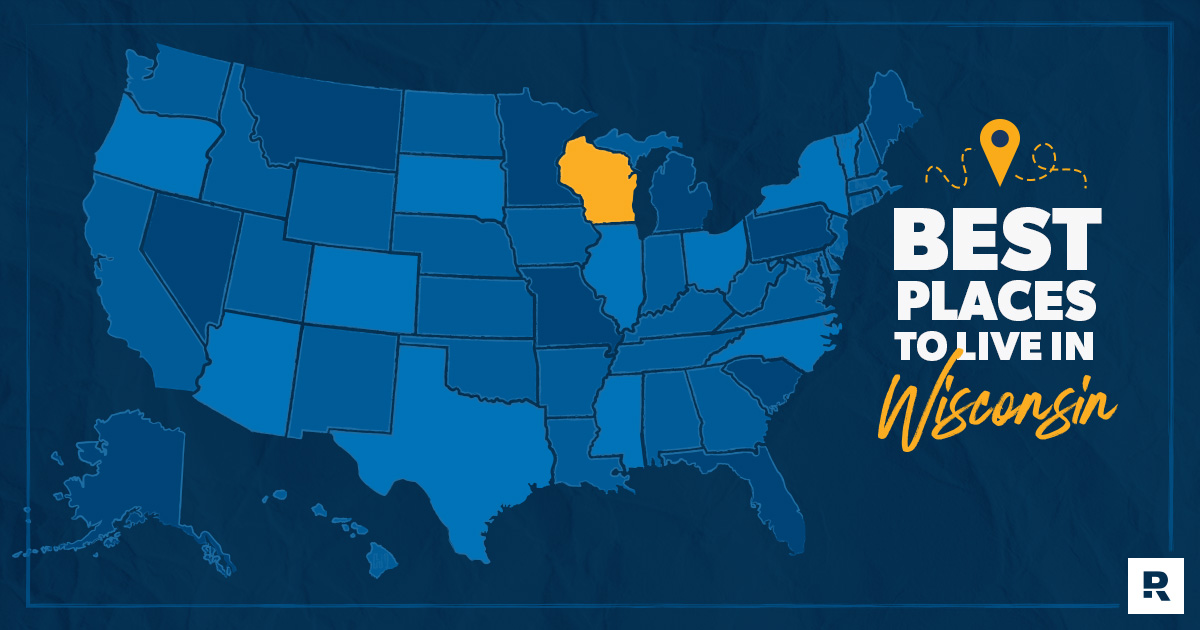

Best Places to Live in Wisconsin

How to Budget by Cash Stuffing Envelopes

Best Tips for Having a Successful Garage Sale

How to Open a Roth IRA

11 Ways to Overcome the Fear of Failure

10 Frightening Retirement Statistics That Should Scare You Into Action

Get Inspired With Weekly Money Tips Sent Right to Your Inbox!