The word budget often gets a bum rap. People worry it’ll be like putting a straitjacket on their spending. But budgeting doesn’t tell you not to spend. It gives you the power to spend the right way—to show your money who’s boss.

Okay, but we know becoming a budgeting boss can seem like a long way off. There’s so much to learn, right? Hey, if you’re worried or confused about everything you need to know about the budgeting life, fear not. You can—no, you will—get there. Yes, really. Read on.

What Is Budgeting?

Let’s start with a solid definition of budgeting. A budget is just a plan. It’s not a restriction on spending—it’s a plan for what you’ll do with all your money. It’s a plan for what’s coming in and what’s going out. When you budget every month, you’re giving your money purpose. You’re telling your money where to go so you’re not left wondering where it went.

Why Should You Budget?

Why do we love budgeting? Let us count the ways. Actually, that would take forever. But here’s the deal—you work too hard for your money to wonder where it all went at the end of the month. So, let’s look at why you should budget.

The Benefits of Budgeting

When you know where your money’s going, you can crush your money goals faster. With a budget, you won’t have thoughts like, Why can’t I pay my freaking bills every month? I make too much to be this broke.

Like we said, a budget is a plan for your income and expenses. So you’ll be on top of what you make and what you spend. And if you find out you’re spending more than you make, you can adjust your spending to stop doing that.

You can make a change—you just have to know where to start. You can take control of your money—you just need a budget!

Who Should Budget?

Everyone.

Really. You should budget if you’re living paycheck to paycheck (with all your money going out as soon as it comes in). If you have some savings and feel pretty comfortable but want to manage your money even better. If you’re in debt up to your eyeballs. If you’ve never even looked at a credit card.

Really—everyone should budget. Because a budget helps you get ahead of your money, take control of your money goals, punch debt in the teeth and knock it out of your life forever, and so much more. No matter your money background, a budget is for you.

Which Budgeting Method Should You Use?

We have a proven method: It’s called zero-based budgeting. And we don’t beat around the bush about the fact that it’s the best way for you to take control of every single dollar you make. But we want to look at a couple other popular methods too, so we can compare and contrast—and show why you zero-based budgeting wins every time.

50/30/20 Rule

One popular budget plan is called the 50/30/20 Rule. This method sets all monthly spending and saving into three categories: needs (50%), wants (30%), and savings (20%).

At first, this method seems great—because it uses budgeting percentages, which are usually helpful. But the biggest problem with the 50/30/20 Rule is that it leaves only 20% for savings, retirement and extra debt payments. Minimum payments on debt are considered a need, but if you want to pay anything above that, it’ll have to come out of the last 20% that’s set aside for savings.

Start budgeting with EveryDollar today!

That kind of thinking makes for very slow progress toward your money goals. Because if you’re in debt, you’ll want to throw more than 20% of your income at those payments to crush debt for good. After that, you can move on to saving and investing.

When you use the zero-based method, any money left over after you budget for all your expenses goes toward your current Baby Step. (The Baby Steps are money expert Dave Ramsey’s proven plan for winning with money.) You aren’t stuck at only 20%. And you aren’t throwing money at three goals at once. You’re tackling your money goals one at a time and focusing all your intensity on getting them done.

60% Solution

This method says to put 60% of your income toward committed expenses—aka the things you need and any nonessentials you’ve committed to. The rest of your income is divided up into four categories: 10% to retirement, 10% to short-term savings for irregular expenses, 10% to long-term savings for emergencies or large upcoming needs like a new car, and 10% for fun.

While we applaud the emphasis here on savings, we’re not into lumping needs in with the things you’ve “committed to.” You can commit to a lot of expenses that you really don’t need, like an expensive phone plan or too many TV streaming services.

Also, we’ve found people are far more motivated to follow a path where goals get knocked down one by one. It provides intense motivation when you can say, “I did the thing! Now on to the next thing!” Zero-based budgeting means breaking up your long financial journey and taking it one focused (baby) step at a time.

The 60% Solution tries to make budgeting simple. That’s great! But it clumps too many categories together, making this method too complicated in the end.

Reverse Budgeting Method

Well named, this method starts with savings and then tackles spending. It suggests beginning your budget by setting aside money to save and invest. After that, you budget for essential expenses like housing, utilities, transportation, food, insurance and debt. Finally, you cover nonessentials and fun.

This method is anti-debt, which we’re all about. But we’re also about taking down the debt before you load up your savings and start investing for retirement. Your income is your largest wealth-building tool. And being debt-free means using that tool to its fullest potential, rather than losing it to interest payments.

The Zero-Based Budget

Simply put, zero-based budgeting is when all your income minus all your expenses equals zero.

That means all the money going out should be the same amount as the money coming in. So, if you make $5,000 a month, you’re giving all $5,000 a job: paying bills, saving money, paying off debt, and living life! When you add in every source of income and then subtract every single expense, your budget should end up at zero.

Here’s an important callout: Your bank account should never hit zero. Keep a little buffer in your checking account of about $50–200, depending on what works for you.

But your budget should hit zero every month. Because you’re budgeting all those dollar bills. Every. Single. One. Here’s the idea behind zero-based budgeting: Anything that’s “extra” doesn’t stay extra. It’s given a purpose and a job. It doesn’t get spent accidently on coffee runs or convenience-store candy. It doesn’t disappear. It works for you—every last dollar of it.

What Goes Into Your Budget?

All your sources of income (that means your regular paychecks plus any side income) and all your expenses (that means your essential expenses and your extras) need to show up in your budget.

If money is coming in or going out, it needs to be in the budget.

How Do You Start Budgeting?

Budgeting might seem intimidating at first, and it honestly does take time to get used to it (usually three months). But—once you get the hang of it, the benefits far outweigh the possible struggle at the start. Because you’re about to look your money in the eyes (not literally, of course) and say, “Hey. I worked hard for you. Now it’s your turn to work hard for me.”

Budget Percentages

People often ask for set percentages to help them set up their first budget. The thing is, budget percentages are different for everyone, depending on the stage of life they’re in.

Here are the two hard and fast percentages we give: Don’t spend more than 25% on your housing, and always give 10%. This is how you keep from spending too much on housing and avoid becoming like Scrooge before the three ghosts changed his stingy heart.

Don’t buy more house than you can afford. Do have a generous heart.

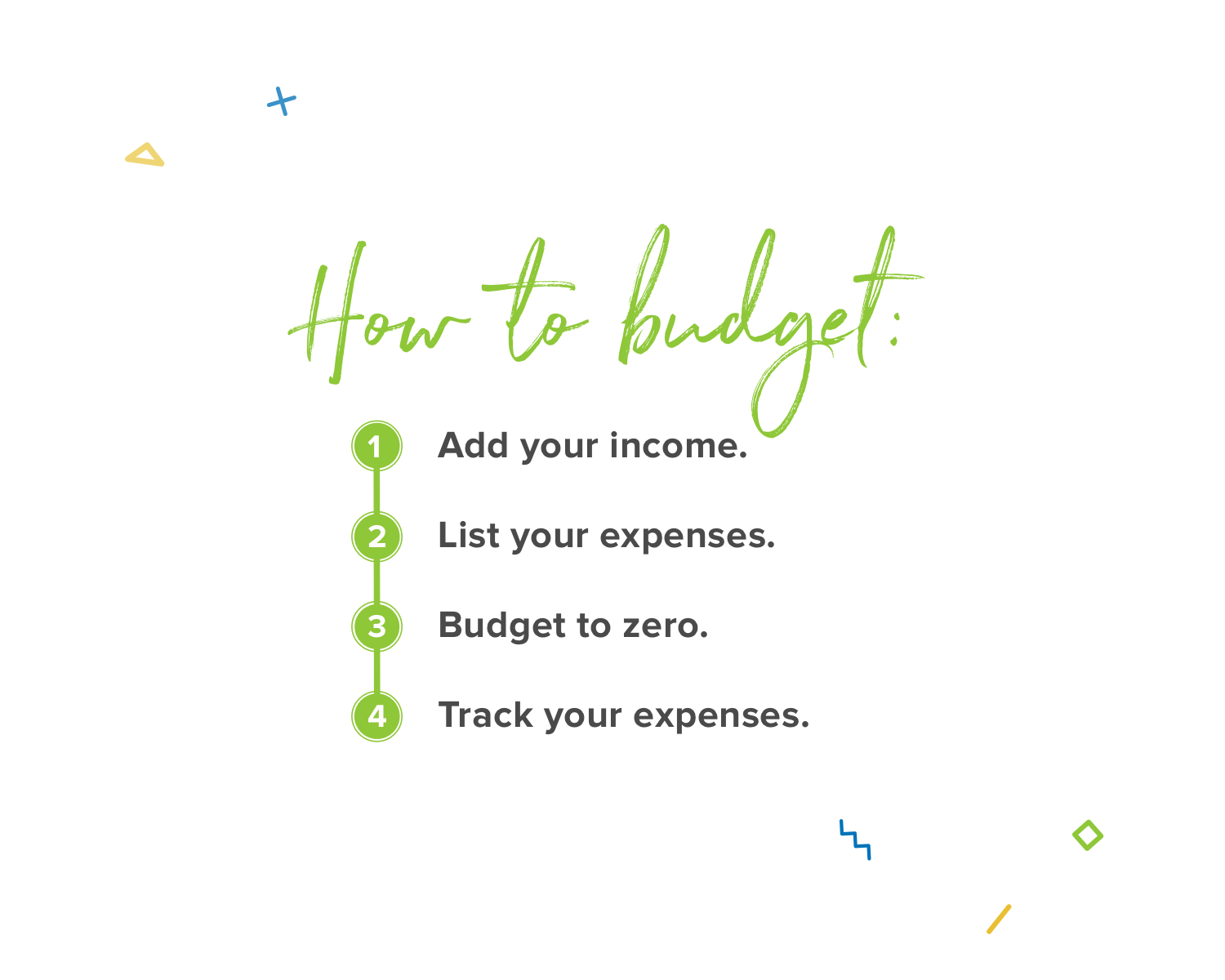

How to Set Up Your Monthly Budget

Setting up your budget every month is as easy as 1, 2, 3 . . . 4. Here’s how:

1. Add your income.

A budget starts with your income. All of it. Like we said before, that means your normal paychecks and any extra income that may come your way through a side hustle, garage sale, freelance work, child support, and the like.

2. List your expenses.

Next, list out your expenses. Start with the essentials (what we call the Four Walls): food, utilities, shelter and transportation. Then, add in the nonessentials like TV streaming services, restaurants, adult kickball league fees, subscription boxes, personal spending, and such.

3. Budget to zero.

This means you need to use the zero-based budgeting method we talked about earlier. If you still have money left over after you list all your expenses—chuck it at your current Baby Step! Boom.

And if you have negative money left over—that means you’ve spent too much. Adjust your budget lines and take some money out of all those nonessential categories until you get to zero.

4. Track your expenses.

This last step is key: Track. Every. Expense. When you spend money, log that purchase into the correct budget line. This is how you’ll keep an eye on everything. Budgeting is how you plan. Tracking is how you keep up with the plan.

How Do You Budget With an Irregular Income?

So, maybe you don’t make the same amount of money on every paycheck. If that’s you, you aren’t alone. Plenty of people work hourly or have side gigs that change up their income every month. The best thing you can do is set up your budget based on your lowest monthly estimate. It’s easier to start with your lowest monthly income than to start with an average. If you budget for the smallest amount, you can always go up from there!

Check out your pay stubs from the last year and find the lowest one in the bunch. If this is your first time working on commission or living on an irregular income, estimate what your lowest month will look like. That’s what you should put in as your income when you set up your budget.

Next, add your expenses just as we mentioned above. But be prepared—if you have an irregular income, you may not be able to enjoy certain extras every month. For example, if you have a month of lower income, that might mean you can’t go out to the movies—because you have to cover your needs before your wants.

The key to winning with budgeting on an irregular income is being flexible and staying on top of it. Adjust as you get paid. If your income is higher than you planned, make sure you add it into your budget. So if you set your monthly income to $4,500 but actually made $5,000, put that extra $500 in as income. And do a happy dance. Because the extra income means you can throw more money at your Baby Step.

How Do You Budget for Fluctuating Bills?

Fluctuating bills is an odd-sounding term, but it just means the bills that aren’t set—that aren’t the same every month. This includes bills with different amounts due and different due dates. They don’t make it impossible to budget—you’ve just got to be ready for them. Here’s how:

Bills That Change the Amount Due Each Month

Your electricity, heating and water bills (unless you set up a predictable billing plan) and your gasoline budget line—these are examples of expenses that change month to month. Maybe it’s so hot that you run the A/C more. Or maybe it’s soccer season, so you’re driving more to get the kids to practices and games every week.

The first way to keep on top of this situation is by planning ahead. You should always budget for the month before it begins by looking at that month’s social and holiday calendar and thinking about what kind of month-specific or different spending may be coming your way. Like if it’s going to be hot—up that electricity budget.

The next way to win here is to budget a little higher than you think. It’s always nice to get your water bill and see it’s lower than you planned. Then you can put that leftover money to work on your current Baby Step!

Bills That Are Charged Semi-Annually

If you have bills that come around only a couple times a year, such as insurance, you have a couple options. If it doesn’t tack on any added expenses, see if you can switch over to monthly payments. Otherwise, create a sinking fund (a way to save up for big expenses over time). Let’s say you pay $300 every six months for car insurance. That means you should set aside $50 every month to prep for that bill. When it comes, you’ll have the cash ready and won’t have to scramble to get it paid.

What Can You Expect in the First Three Months of Budgeting?

Remember learning to ride a bike? We don’t either. But think about some skill you do remember learning. It kind of sucks at first, right? You aren’t good at it. But that’s okay. That’s why they call it learning and not knowing.

Just like learning any new skill, budgeting requires a little bit of practice and patience to get right. And we know you can do it! For most users, it takes about three months to go from clumsy to comfortable. But just like the bike—eventually you’ll be so good at it you’ll forget the learning experience and live in confidence.

How Do You Budget for Unexpected Expenses?

First off, you need to get a grasp on the difference between unexpected and overlooked expenses. Here’s how they’re different:

-

Having to buy new tires because you didn’t notice the tread was wearing out = overlooked.

-

Having to buy a new tire because you got an irreparable flat = unexpected.

-

Paying for that annual trip to Grandma’s at Christmas = overlooked.

-

Paying for a quick flight to a funeral = unexpected.

For the most part, you can prepare for those overlooked expenses by planning ahead. Check the treads of your tires. Save little by little each month to prep for the trip to Grandma’s. You know these things are coming—so be ready with a sinking fund.

Now, unexpected expenses are a whole other beast. For these, you need an emergency fund. The best practice with emergency funds is to start with $1,000. Then you pay off all your debt (if you have any). After that, you’re going to build what we call a fully funded emergency fund, which is 3–6 months of expenses.

Life happens. But you can be prepared for the unexpected expenses that come your way if you’ve got money saved up. When you’ve got an emergency fund, you’re ready for those “life happens” moments.

5 Tips for a Successful Budget

1. Plan a monthly budget meeting.

You need to budget every month. Get yourself a budgeting accountability partner. That’s someone who will encourage you, cheer you on—and also call you out when needed. Got a spouse? Boom. You’ve got a built-in accountability partner.

Get with your accountability partner every month to check in and set up the next budget. If you’re married—do this together and in person. If you’re meeting with a friend or family member, you’re welcome to make your budget alone, but never skip the check-in. There’s no shame in asking someone to help you keep your eye on the goal. Just the opposite—there’s incredible strength in seeking accountability.

If you aren’t sure how to make it happen, grab yourself a copy of our one-page budget meeting guide (the classic or the couple’s version) to rock those meetings and those budgets.

2. Track your spending.

Your budget isn’t a robot vacuum cleaner. You can't push one button and let it do all the hard work. You’ve got to get in there and track your expenses. This is how you see if what you planned to spend lines up with what you really spend. This is how you’ll know if you need to adjust a budget line. Or just stop spending money already. Yes, that’s an option—and a good one! When you track your expenses, you’ll be in the know and in charge.

3. Make adjustments to your budget.

Your thermostat, attitude and budget—all three sometimes need adjusting. When you underspend or overspend in one budget line, make up for it in another. For example, if the grocery bill is higher because you had unexpected guests to feed all weekend, well, that happens. But the extra money won’t magically appear. You’ll have to take it from a different budget line. Looks like you might be spending less on eating out or entertainment this month.

Adjusting your budget is a necessary thing. But remember this: Never stop your debt snowball to cover front-row tickets to your fave band’s reunion tour. Wants come after needs. Always.

4. Learn to say no (or not now).

As we said before, a budget doesn’t tell you not to spend. It gives you the power to spend the right way. And sometimes what’s right is saying no to buying something—or maybe saying not right now. Learn to say later—when you can save up for it. Later—when it’s in the budget.

And hey, “It isn’t in the budget” aren’t curse words. Those mighty words will save you time and again. You are in control of your money. You set up that budget so you can enjoy life while still working on future money goals. So, learn to say no to some things now for the sake of something wonderful later!

5. Stay motivated to budget.

You’ve got money goals. Good. So if budgeting ever gets hard or feels like just one more task on your to-do list—remember those money goals. That’s the best way to stay motivated to keep on budgeting every single month.

Put pictures of your goals up on your bathroom mirror or fridge. Write “why I budget” on top of them. Of course, these goals aren’t the only reason you budget. But they’re a great thing to focus on when life or budgeting gets tough.

We’ll be honest: It’s way easier to crush these money goals when you’ve got a budgeting tool. And it’s way, way easier when that tool is mobile and built on the same hard-hitting money principles we’ve talked about.

That’s EveryDollar.

We know it takes hard work to do what’s right with your finances—budgeting, spending wisely, saving well—and we believe in you. Because EveryDollar is just a tool (an awesome tool, yes, but just a tool), but you’re the one jumping in and budgeting to make real changes with your money—and your life!

So, yeah—budgeting can be hard. Life is tough. But. You. Are. Tougher. And you can do this.