How to Prevent Identity Theft

13 Min Read | May 14, 2024

Listen to this article

It’s official! We live in a very public digital world, and our personal information is all over the place. We all love how devices make it simpler to pay bills, shop and socialize online. But they also make it easier for hackers to steal our identity! It’s like rolling out a welcome mat that says, Come on in. Thieves welcome!

Hold up though. Don’t start avoiding the internet just yet—there are some easy ways you can remove that welcome mat before thieves get to your virtual doorstep. We’ll walk you through each line of defense against evil hackers—let’s get started!

What Is Identity Theft?

First, here’s a simple definition: Identity theft is when someone steals your identity and uses it without your permission for their own financial gain. (Gross, huh?) Using a bogus identity is fraud, and it has been a growing problem in the United States for decades. Then came the COVID-19 pandemic and greedy online thieves upped their game to target relief checks and unemployment benefits.

The pandemic is finally behind us (fingers crossed!). But now hackers are targeting post-pandemic consumer spending and stealing online information (aka your personal identity) using entry points like credit card numbers, social media logins, bank accounts and Social Security profiles.

Once they break through your supposedly secure encrypted data, they can do anything they want with your identity. Sometimes it takes years to untangle the financial and personal damage that identity theft causes. Sounds horrible!

What's your risk of identity theft?

Take this quiz to assess your risk.

How to Prevent Identity Theft

The good news is that identity theft prevention is possible. Here’s a comprehensive list of how you can protect yourself online:

- Freeze Your Credit

- Install Antivirus Software

- Make Privacy a Priority on Social Media

- Keep Your Phone Secure

- Never Use Unsecured Wi-Fi

- Change Your Passwords Every 90 Days

- Enable Two-Factor Authentication on All Devices

- Check Your Online Bank Account Every Day

- Don’t Send Bill Payments From Your Postal Mailbox

- Don’t Fall for Phishing Scams

- Don’t Forget About Your Kids’ Information

- Pay Attention to Data Hacks and Breaches

- Guard Your Social Security Card and Bank Account Numbers

- Monitor Your Medical History

- Shred All Sensitive Documents

- Wipe Electronics Before Donating

- Opt Out of Prescreened Credit Card Offers

- Review Your Credit Reports

Freeze Your Credit

Freezing your credit is one of the best ways to stop identity theft. While your credit is frozen, no one, including you, can open an account, apply for a loan, or get a new credit card using your financial information.

Try 30 days of identity theft protection free from our RamseyTrusted provider.

It’s free to freeze your credit. It’s a great move. And at Ramsey, we believe in getting rid of debt for good. So, while you can unfreeze your credit anytime you want to, why would you? Freezing your credit also won’t hurt your credit score—but if you’re living without debt (and you should) your credit score just isn’t that important anymore!

Install Antivirus Software

If you don’t stay up-to-date with antivirus software, you’re an easy target for online thieves. And that means it’s something you really need to get done no matter what. Help prevent identity theft by routinely checking for updates and installing anti-keylogger software so no one can hack into your computer.

If you want added protection, make a habit of logging out of any account you access on your computer or mobile device. We’re talking anywhere you use a username and password to log in.

Is it more convenient to stay logged in 24/7? Sure. But doing little things like this can give you greater peace of mind and help you prevent identity theft.

Oh, social media. Some people just love to share every detail of their life without thinking twice about how public they’re being with their personal information. But thieves are watching, and taking notes, all the time. To be safe, set your privacy settings to the highest level.

Also, don’t share personal information like your exact birthday (including the year), address or your mother’s maiden name.

Keep Your Phone Secure

Since your phone contains so much of your personal life these days, it’s important to keep it secure. Take advantage of the passcode, fingerprint scan or face recognition to get into your phone. Keep your Bluetooth turned off when you aren’t using it. And if you have an iPhone, register it with iCloud so you can remotely wipe your phone if it gets stolen. Who knew clouds could be so powerful?

Of course we hope your identity is never stolen, but if someone does steal it by hacking into your phone, you can get some relief by reading our deep dive on what to do if your phone is hacked and how to prevent it from ever happening again.

Never Use Unsecured Wi-Fi

As tempting as it might be to sit at Starbucks and sip your latte while going over your bank statements online—don’t! Unsecured, public Wi-Fi is just that: unsecured. Everybody sitting around you is on the same open network and can easily get access to your information. If you need to log on to your banking website, wait until you get home.

And while we’re at it, your home Wi-Fi must be secured with a password. Otherwise, anyone near your home can hop onto your network and steal your identity. Good passwords make good neighbors. Don’t give a potential thief the opportunity!

Change Your Passwords Every 90 Days

This includes passwords to your bank accounts, email and social media. Once a thief gets one of your passwords, they’ll try it on many other sites. Make your passwords difficult combinations of uppercase letters, lowercase letters and special characters.

Instead of trying to meet the minimum character count, make your passwords long. Use a phrase or a few random words strung together to really keep the hackers on their toes.

Try to use phrases that aren’t easy to guess. (Sorry, that means famous quotes and Bible verses aren’t good fallbacks.) Get creative! Be sure to use a different password for each account. In other words, don’t use the same password for all your social media profiles, email addresses and banking accounts. And we know it’s a pain to make up so many different combinations—but it’s way better than the nightmare of identity theft!

Enable Two-Factor Authentication on All Devices

Two-factor authentication has become standard practice on the internet as a surefire way to prevent identity theft. It’s annoying, yes, but if you want to learn how to protect yourself from identity theft, we suggest you get familiar with two-factor authentication.

Here’s how it works: If you (or anyone) try to sign in to your account from another device, you’ll need to pass an extra level of security with a six-digit verification code. Once you request the code, it’s sent to one of your trusted devices via a text or a phone call. The device could be your phone, a Mac, PC, iPad, or even a security token or dongle (which can be bought separately to sync up with your Apple or Android products).

Here's why two-factor authentication is so effective. Hackers are just as frustrated (hopefully more!) as you are trying to access your information and having to get through two security checks instead of one. It’s a great way to prevent them from stealing your stuff.

Check Your Online Bank Account Every Day

Banks do have systems that watch your spending patterns, and they’ll flag your account if they see something irregular. But it’s still important to log in every day and make sure there aren’t any strange charges on your account. You’re the first line of defense in preventing your identity (and money) from being stolen.

Don’t Send Bill Payments From Your Postal Mailbox

Stealing mail directly out of that humble mailbox of yours is the easiest type of identity theft. So don’t put checks in there! Use the post office or a USPS mailbox. If a thief gets your bank account and routing number from a check you were mailing, fraud is even easier.

Grab any mail out of your mailbox as soon as possible. Thieves thrive on swiping those credit card mailers. And how about those utility bills? Changing to paperless billing can help keep your details away from potential mail thieves.

If you want to tighten up even more, consider using a locked P.O. box at your local post office.

Don’t Fall for Phishing Scams

Never open emails that look strange or suspicious. These are often phishing scams trying to gain access to your personal information. Read email subject lines and the “From” address carefully before opening any email, clicking on links, or downloading attachments. And always be on high alert if they ask for your personal or financial information. If you think it sounds suspicious, it probably is.

Don’t Forget About Your Kids’ Information

It’s sad, but true—even your toddler can fall prey to identity theft! Kids are easy identity theft targets because thieves correctly assume it will be a long time before the theft is detected. Kids aren’t credit active until they turn 18, so most parents never even know about the fraud until then.

Check out TransUnion’s free Child Identity Theft Inquiry. Fill out your child’s information, and you’ll receive an email back.

If it reports that your child has a credit file, that’s a bad sign. Your credit isn’t like your Social Security number. You’re not born with credit, so you’ll only have a credit report if you’ve ever used credit. If someone is using your kid’s Social Security number, take immediate action.

Pay Attention to Data Hacks and Breaches

If you’re notified of a data breach (like the Equifax hack or the Target data breach a few years ago), start paying extra attention. It doesn’t mean you’re a victim, but it does increase your risk. You can take proactive steps to strengthen your defense from potential future hacks by using our tips.

Guard Your Social Security Card and Bank Account Numbers

It should go without saying, but we’ll say it anyway—to prevent identity theft, protect your Social Security card and number and all other forms of identification.

The worst type of fraud is when someone has your unique name, date of birth and Social Security number. They can get a job, file taxes, and even receive medical care in your name.

Protecting your Social Security number is really crucial. Do you keep your Social Security card in your wallet? Don’t! What if someone steals it? That means they just stole your identity!

Oh, and make sure you don’t have your debit card PIN written down anywhere. That’s like leaving your keys in the car and wondering why it got stolen!

Monitor Your Medical History

A lot of people forget about medical identity theft, which is another major way thieves can steal information from you. You need to safeguard your health information as carefully as any other form of identification.

Shred All Sensitive Documents

Don’t forget dumpster diving is still a thing. (And sometimes it’s legit—but that’s a different article.) Even as thieves constantly come up with new and improved digital scams, the old-fashioned way of stealing personal information by sorting through your trash is alive and well.

What’s the best way to prevent thieves from rifling through your trash for clues to your identity? Keep a few months of credit card and bank statements, utility bills, IRS communication—anything that has your personal information on it—in a safe location like a lockbox and shred anything older.

Wipe Electronics Before Donating

Ever watched any true crime shows? You might have noticed that simply emptying your computer’s trash bin doesn’t mean the information is actually gone forever. Hackers (and digital forensics engineers apparently) know exactly where to look for files you thought you permanently deleted. They can use that information however they want, and it’s usually not in your favor.

So, before you drop your old laptop off at an e-recycling station, completely wipe your hard drive to make sure your personal information is truly gone. You can easily find disk-wipe tools online that will erase your hard drive for free.

Opt Out of Prescreened Credit Card Offers

Here’s another sneaky hacker trick you might not have thought about. Credit card companies often send prescreened offers to open new accounts. Knowing this, criminals intercept the offer and open an account in your name.

Instead of throwing those offers in the trash where thieves can find them, make sure to give them a run through the shredder. An even safer way to avoid identity theft exposure from prescreened offers is to opt out of receiving them permanently.

Interested in learning more about identity theft?

Sign up to receive helpful guidance and tools.

Review Your Credit Reports

Staying informed is a smart line of defense for preventing identity theft. Did you know you can get a free credit report from each of the three credit bureaus once a year?

Here’s an easy way to check your credit every four months: Get a report from one company at the beginning of the year, another in the middle, and another at the end of the year. Then, start all over again next year.

Regularly checking your credit report will help you spot any odd activity that might pop up. Here are some identity theft red flags we recommend you look for on your credit report:

- Inactive accounts that suddenly have activity on them

- A line of credit you didn’t open

- Incorrect personal information

- A good-standing account in collections

- A credit inquiry you didn’t apply for

If you see something strange on your credit report, take immediate action. You have the right to dispute any information that looks wrong. Notify the credit bureau so they can look into the issue. They’ll contact the company in question and dispute the charge. Depending on what they find, you may need to give them more info for their investigation.

How to Report ID Theft

Are there really exceptions to every rule? Yes, and unfortunately that includes identity theft protection. Just in case some random brilliant hacker finds a tiny hole in one of your theft protection strategies, we’ve got you covered for that too.

The first thing to do when you realize your identity has been stolen is to call the Federal Trade Commission (1-877-438-4338) or contact them online. The FTC will collect the details of your case and direct you to the right resource.

The investigation type and the exact recovery process will depend on what kind of identity theft that occurred—credit card, taxpayer identity or benefits identity. Regardless of the type of identity theft, take extensive notes during phone calls and keep all related written correspondence.

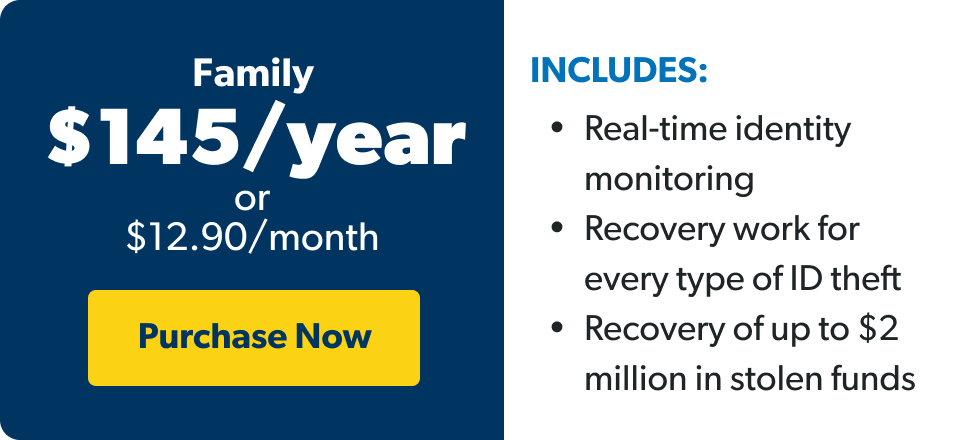

Work With Experts to Stop Identity Theft

Even with all these precautions, identity theft can happen. If it does, you’ll want someone in your corner who knows what they’re doing. That’s why we recommend RamseyTrusted provider Zander for identity theft protection. They’ll do all the heavy lifting for you including:

- Monitor your information in real time and alert you of any risks

- Provide full-service identity recovery services for you if needed (they’ll clean up the entire mess for you!)

- Recover up to $1 million of stolen funds (including legal fees)

Get started preventing identity theft today!